Articles

From Niche to $67B: The Rise of Litigation Finance as a Global Asset Class

From Niche to $67B: The Rise of Litigation Finance as a Global Asset Class

If you’ve been noticing more chatter about litigation finance lately, it’s not your imagination. What started as a niche way for plaintiffs to get some funding has blown up into a mainstream asset class that institutional investors can’t ignore. With legal bills soaring and cases growing ever more complex, third-party funding is shifting from a “nice to have” to a “must have” for many law firms and plaintiffs. And for firms like BroadRiver Capital, that presents a ripe opportunity to lead and expand provided they can navigate shifting regulations and embrace new funding structures.

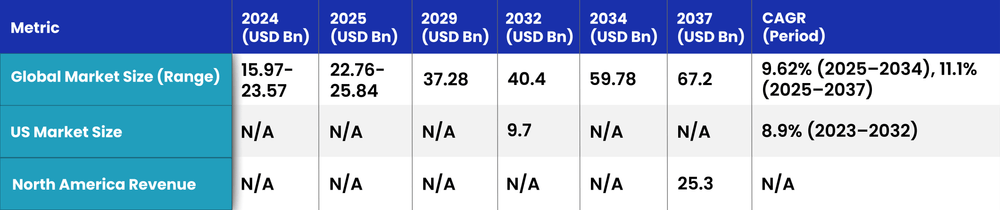

Globally, litigation funding was pegged at around $20.06 billion in 2024 by one source, with others ranging up to $23.57 billion or down to $17.5 billion. Forecasts show it climbing to somewhere between $22.8 billion and $25.8 billion in 2025, then on to nearly $37.3 billion by 2029, and potentially approaching $67.2 billion by 2037 implying compound annual growth rates of roughly 9.6–13.4% depending on which study you trust.

North America, and the U.S. in particular, dominates. In 2023 the U.S. market was about $4.5 billion, and it’s forecast to more than double to $9.7 billion by 2032 (an 8.9% CAGR). By 2037, North America could be generating $25.3 billion in litigation funding revenue, with just the commercial litigation segment adding $27.7 billion between 2025 and 2037.

Part of the challenge in pinning down exact figures is that litigation financing deals often happen privately, with no standard reporting requirements. That means anyone trying to size up the market has to lean heavily on proprietary data, deep industry relationships, and a critical eye toward differing methodologies.

Table 1: North American Litigation Finance Market Projections (2024–2037)

Bottom line: litigation finance is moving from discretionary to essential. It’s about ensuring access to justice when plaintiffs can’t or won’t front massive legal bills.

It’s tempting to focus on those 20%+ annual returns equity-style deals with performance kickers often outperform straight debt financings (especially in mass torts and personal injury) . But the flip side can be painful: if a funded case fails, the funder can lose 85–95% of their investment. In commercial portfolios, ~34% of cases produce negative returns; in big personal-injury claims, around 7% end in partial or full write‐offs.

Key takeaways:

For institutional investors, the combination of high upside potential and high downside risk underscores the importance of a portfolio approach. Litigation funding can be a stellar diversifier, but only if deployed with discipline and expertise.

Over the past few years, we’ve seen clear winners in both case types and funding models:

On the funding side:

Table 2: Key Litigation Types and Funding Models Gaining Traction

This shift toward portfolio and hybrid funding underscores a maturing market: funders want stable, long-term relationships with law firms and diversified pipelines of cases, rather than one-off wagers.

Historically, doctrines like champerty (profiting from another’s suit) and maintenance (backing litigants without direct interest) barred third-party funding. Today, most U.S. states and Canadian provinces have relaxed those rules, viewing funding as enhancing access to justice so long as funders don’t control litigation decisions.

In the U.S.:

In Canada:

That regulatory diversity creates both hurdles and advantages. On one hand, funders need savvy compliance teams to tailor structures across jurisdictions. On the other, clearer rules especially in Canada lend legitimacy, attracting more institutional capital. Ethical transparency and preserving attorney independence aren’t just nice; they’re competitive advantages.

While North America is the heartland today, fast-growing markets are emerging worldwide:

New segments are also opening up:

For a firm like BroadRiver, that means mapping a global footprint, building regional expertise, and experimenting with defense-side or sector-specific offerings to diversify risk and capture new revenue streams.

Technology is reshaping every part of the value chain:

These tools turn litigation finance into a quantitative, scalable business. No longer purely a human-judgment game, underwriting can leverage terabytes of historical data to refine pricing, monitor case health in real time, and adjust capital allocations dynamically.

Putting it all together, the road map for a top-tier funder looks like this:

By marrying cutting-edge tech with thoughtful diversification and a global mindset while staying scrupulous about ethics funders can not only ride the growth wave but help shape the future of litigation finance itself.

That’s the story of North American litigation finance today big numbers, evolving deal structures, regulatory twists, and technology’s rapid ascent all woven together in a market that’s anything but static.