Blogs

How Private Equity (PE) Firms Use Portfolio Optimization to Maximize Returns

How Private Equity (PE) Firms Use Portfolio Optimization to Maximize Returns

In the high-stakes world of private capital, yesterday's strategies won't win tomorrow's markets.

Is your firm's portfolio management truly aligned with evolving private equity trends? For instance, today’s private equity firms are ditching slow, manual methods for dynamic, tech-driven solutions. Real-time, data-driven portfolio optimization is no longer a luxury; it's essential for survival.

This article breaks down the modern optimization engine: tactical allocation, dynamic rebalancing, ESG integration, and attribution analysis. We’ll show how embedding optimization into daily workflows with partners like Decimal Point Analytics (DPA), creates agility and superior returns.

Scenario-driven asset mix strategies aligned with macroeconomic signal.

Static asset allocation is an outdated idea in private markets. Today’s managers face unpredictable cash flows and fast-changing risks. To succeed, modern private equity investment strategies need a tactical framework driven by real-time economic data.

This means matching investments to market intelligence and building a portfolio that is resilient and agile. Advanced tactical asset allocation strategies include

Using these frameworks helps firms move from reacting to the market to predicting it. This insight can even shape future private equity deal flow by highlighting the sectors with the most potential.

Multi-factor models adapting to real-time portfolio signal

Rebalancing used to be a rigid, calendar-based task that ignored market swings. Dynamic rebalancing is a smarter approach. It uses intelligent models to continuously monitor the portfolio, helping managers adjust exposure as companies mature and prepare for optimal exits.

This advanced approach to portfolio rebalancing & optimization adds value by:

Measuring what drives returns across time, risk, and exposure

The key question for any manager is: "Where did our performance come from?" A robust performance attribution analysis is the only way to answer this precisely. It separates true manager skill (alpha) from market movement (beta), showing how much value came from operational improvements versus leverage or multiple expansion.

Its basis is in developing custom benchmarks and index solutions. A standard index is a poor yardstick for a specialized fund. Our specialty in benchmark/index customization allows managers to accurately isolate their value-add and justify their strategies to LPs. Our performance attribution and benchmarking frameworks help isolate alpha and align performance to strategy.

Integrating ESG into fiduciary mandates and strategic returns

Environmental, Social, and Governance (ESG) is no longer a simple checkbox; it is a core driver of long-term value. Modern ESG integration in portfolios treats it as a critical business factor focusing on:

Evaluating the place of private credit, hedge funds, and commodities

Many PE funds diversify further into assets like private credit or real assets. A disciplined Alternative Investment Analysis capability is essential to understand how these assets impact the entire portfolio. This analysis includes risk-return calibration to see how a new asset changes the portfolio's overall risk profile, drawdown simulations to test how it would handle a market crash, and correlation analysis to understand how assets move together.

Crucially, it also involves a liquidity impact assessment to gauge how illiquid assets will affect the fund’s cash flow.

Unlocking optimization value across industry verticals

Tailored asset optimization strategies must be employed in each industry to be effective.

Why traditional models fall short in dynamic private markets

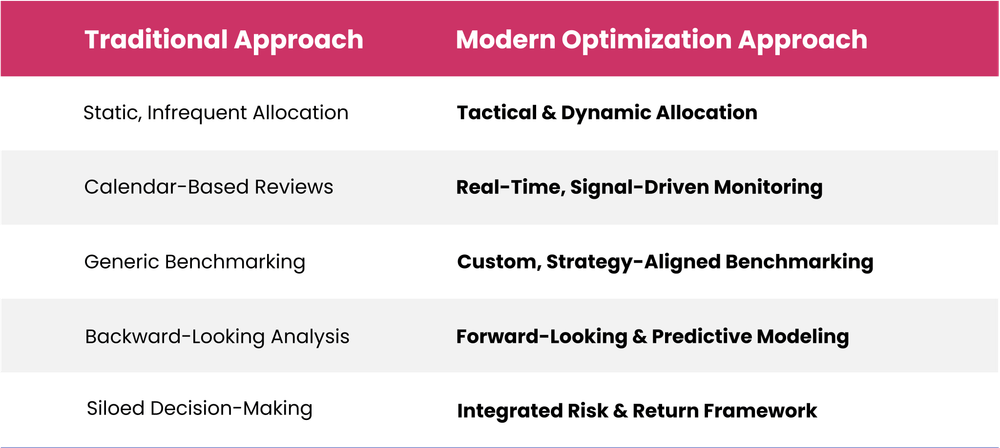

The gap between old methods and modern optimization approach is widening. Relying on a traditional approach is a strategic liability.

Dynamic optimization with tools from partners like Decimal Point Analytics provides the speed needed to win.

Tools, dashboards, and analytics embedded into workflows

The best models are useless if they are not part of daily decisions. The goal of data analytics in private equity is to embed actionable intelligence directly into a manager's workflow. This requires robust ETL (extract, transform, and load) frameworks to centralize data from all sources, predictive reporting to generate forward-looking insights automatically, and interactive investment dashboards that allow managers to visualize data and test ideas in real-time.

Faster insights and improved execution through analytics

The Challenge: A large asset manager’s legacy analytics were slow and inaccurate, hindering decisions in volatile markets.

The Solution: A full system rebuilt with predictive models, automated data pipelines, and real-time, interactive investment dashboards powered by predictive dashboards and optimization engines - dramatically improving forecasting speed and decision accuracy.

Quantifiable Impact:

This case study demonstrates the value that a modern analytics framework from Decimal Point Analytics can deliver.

The path to superior returns in private equity is now paved with data. A modern approach combines tactical allocation, dynamic rebalancing, meaningful ESG, and clear attribution into one smart system. This is the new standard for modern private equity.

In today's world, portfolio optimization is no longer a competitive edge - it is a necessity. Decimal Point Analytics is your partner in this journey, helping you shift from reacting to the market to predicting it.